Tuesday, June 11, 2013

Sunday, June 9, 2013

The Shale Gas Boom Offers Environmental Investment Opportunities

Natural gas has recently emerged as a relatively clean energy source. This has dramatically changed the U.S. energy and environmental markets. Some of the most interesting investment opportunities in the shale gas revolution are in the suppliers helping the industry to operate more efficiently and reduce pollution. In this article I will present five companies that have already been great investments but could be even greater going forward.

Read more on Seeking Alpha

Friday, June 7, 2013

Preventing Contrast-Induced Acute Kidney Injury Creates Investment Opportunities

The administration of radiocontrast media can lead to an usually reversible form of acute kidney injury (formerly called acute renal failure) that begins soon after the contrast is administered. In most cases, there are no permanent sequelae, but there is some evidence that its development is associated with adverse outcomes.

Contrast-induced nephropathy ("CIN") is defined as the impairment of renal function and is measured as either a 25% increase in serum creatinine from baseline or 0.5 mg/dL (44 µmol/L) increase in absolute value, within 48-72 hours of intravenous contrast administration.

For renal insufficiency ("RI") to be attributable to contrast administration, it should be acute, usually within 2-3 days, although it has been suggested that RI up to 7 days post-contrast administration be considered CIN; it should also not be attributable to any other identifiable cause of renal failure.

The CIN market is a more than $500 million market which can be conquered by niche players such as AngoDynamics (ANGO), PLC Systems (PLCSF.OB) and Australian listed Osprey Medical. Bristol-Meyers Squibb (BMY) has a lack of clear supporting clinical data for its preventive product so they will not profit from this market going forward.

Current Treatment Methods for CIN

The only clinically accepted and routinely utilized preventive measure for patients at risk for CIN is pre- and post- procedure overnight hydration, which is inconvenient, expensive and time-consuming for hospital staff.

There is currently no FDA-approved device or drug for CIN prevention, but it is expected that this will change soon.

Due to the attractiveness of the potential market, there are a number of other companies developing or investigating potential new CIN preventive drugs, devices and therapies.

Preventive measures being used in clinical practice today include:

Mucomyst® N-acetylcysteine (Mucomyst®)

Mucomyst is both a renal vasodilator and antioxidant. It is produced by Bristol-Meyers Squibb . It is prescribed by a doctor prior to the start of an interventional procedure and is taken by the patient in prearranged doses that may start the day before the procedure. This therapy is employed by many physicians due to an extremely low risk profile and cost. A team of Brazilian researchers published data on the largest trial of Mucomyst to date, the ACT Trial. They reported that after studying Mucomyst in 2,308 patients, the rate of CIN was identical between the group of patients who received the drug and those who did not. The results of the ACT trial have reduced the use of Mucomyst as a preventative therapy at many centers.

Sodium bicarbonate

Sodium bicarbonate is a pre-mixed pharmaceutical solution that is given intravenously on the same day as the procedure, prior to the start. A small number of published studies that have evaluated utilizing sodium bicarbonate as a preventive measure. Meta-analysis of these studies and larger studies of the therapy have failed to demonstrate a clear benefit to sodium bicarbonate. The lack of solid clinical evidence for this therapy has led to the a tapering off of the use of sodium bicarbonate at many hospitals.

Device-Based Treatments

CINCOR System

Osprey Medical Systems, formerly known as V-Kardia, Inc., is a United States-based medical device company listed on the Australian Stock Exchange. The company develops catheter based technologies to minimize contrast induced neuropathy ("CIN") in patients with chronic kidney disease. It offers CINCOR contrast removal system, a catheter and vacuum system, which is designed to remove dye (contrast) from the heart before it can enter the kidneys and cause damage known as contrast induced nephropathy ("CIN").

The CINCOR system can be activated multiple times throughout the heart procedure. At the conclusion of the procedure, the small amount of dye-laden blood is discarded. has announced that it has received CE Mark for its CINCOR system and the Osprey announced in March enrolment of their first patient in the CINCOR IDE Clinical Study at the Leipzig Heart Centre in Germany. The multi-country trial will be conducted in 30 hospitals enrolling 600 patients with complete enrolment and FDA submission expected in 2014.

Osprey's public statements list the CINCOR price as between $1500-$2000. Market challenges for this approach may include concerns regarding complications of placing a catheter in the coronary sinus, lack of clear supporting clinical data, and the significant cost of the system. Additionally, published reports to date only indicate that CINCOR removes on average 32% of the contrast injected, which still allows a significant volume of potentially dangerous contrast to pass to the patient's kidney.

CINCOR only works for coronary interventions, so the technology cannot be used in patients undergoing peripheral catheterizations, transcatheter aortic-valve implantation (TAVI), or contrast enhanced CT.

Benephit Catheter

In January 2009, AngioDynamics Inc. acquired certain assets of FlowMedica, Inc., including its Benephit® CV Infusion System, which is a catheter designed to deliver drugs and/or fluid directly to the renal arteries during an interventional procedure.

This system is FDA 510(k)-cleared and CE-marked for the infusion of physician-specified agents in the peripheral vasculature. The Benephit XT infusion system was designed as a universal system to facilitate local drug delivery in multiple settings, as a stand-alone intervention or in conjunction with another medical, interventional or surgical procedure. The system consists of a bifurcated infusion catheter and dedicated 5F introducer sheath that allows for placement from femoral or brachial access sites. The system was designed to provide stability in the vasculature to allow usage in multiple clinical settings as well as in cases where patients may require transport between locations with the Benephit system placed.

In addition to the XT system, AngioDynamics manufactures the CV, Solo and Mini versions for use in specific clinical situations. The Benephit CV system is used primarily in coronary cases if simultaneous infusion is desired during the procedure. The Benephit Solo catheter has one open lumen for those patients with only one open renal artery or one kidney. The Benephit Mini catheter is for use in patients with small aortas, such as those patients with small stature.

In a subset of 285 patients in the BE-RITe registry, the incidence of CIN was 71% lower than predicted (8.1% actual CIN versus 28% predicted) using Mehran risk scoring method. In the BE-RITe registry, catheter-related complications were rare with only 1 case (0.2%) of renal artery dissection that was immediately stented without compromising renal function or causing long-term sequelae.

At the Scripps Clinic in La-Jolla, CA, Dr. Paul Teirstein's study of 33 patients showed a significant increase in renal function with Targeted Renal Therapy ("TRT") compared to IV which was sustained for 2 hours post procedure.

Financials AngioDynamics

AngioDynamics net sales for the third quarter were $81.6 million, compared to $51.6 million reported for the third quarter of fiscal 2012. The company reported a GAAP net loss of $0.03 per share and adjusted earnings per share of $0.08.

In February, AngioDynamics completed the acquisition of certain assets of Microsulis Medical Ltd., including the Acculis MTA microwave ablation system. The system utilizes a single, high-power, high-frequency 2.45 GHz saline-cooled applicator that may provide advantages to clinicians and patients, including faster ablation of soft tissue. During the quarter, the company recognized its first Microsulis sales in the U.S. During the quarter, AngioDynamics executed a sole source contract with a leading IDN to provide vascular access products including ports and peripherally inserted central catheters (PICCs) to their members.

For the nine months ended February 28, 2013, net sales were $252 million, a 54% increase over the $164.1 million reported a year ago and flat on a pro forma basis. Net income was $0.3 million, or $0.01 per share, compared to net income of $1.9 million, or $0.08 per share, as reported a year ago. Adjusted net income, excluding costs relating to the Navilyst Medical acquisition, as well as other costs detailed in the attached reconciliation table, was $9.9 million, or $0.28 per share, compared to $4.7 million, or $0.19 per share, a year ago. Adjusted EBITDA was $39.7 million, or $1.12 per share, compared to $19.4 million, or $0.77 per share, a year ago.

RenalGuard

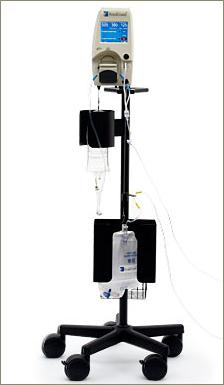

RenalGuard® is designed to reduce the potentially toxic effects that contrast media can have on the kidneys when it is administered to high-risk patients during certain medical imaging procedures. It is believed that allowing contrast media to dwell in the kidneys of certain higher risk patients can lead to contrast-induced nephropathy ("CIN"), a potentially deadly form of acute kidney injury. By inducing and maintaining a high urine flow rate before, during and after these medical imaging procedures, the incidence rates of CIN in at-risk patients can be reduced. RenalGuard facilitates this increased urine clearance automatically, enabling the body to more rapidly void the contrast media, thereby reducing its overall resident time and toxic effects in the kidney. RenalGuard® is manufactured by PLC Systems and is currently an investigational device in the U.S.

It is a safe, innovative technology capable of achieving significant market adoption due to its evidence-based therapy and straightforward integration into hospital environments where contrast agents are routinely used.

The effectiveness of RenalGuard has been demonstrated in two randomized, open-label controlled clinical trials. Both of these studies reported that inducing very high urine outputs with precise matching of intravascular volume significantly reduced the incidence of CIN in at-risk patients.

The RenalGuard System™ is comprised of a Console and a RenalGuard Single Use Set for infusion and urine collection. The Single Use Set contains a urine collection set which connects to a patient's Foley catheter and an infusion set which connects to a standard IV catheter.

The Console measures the volume of urine in the collection set and infuses an equal volume of hydration fluid to match the patient's urine output. The Console relies on proprietary, patented software and electronic weight measurements to control the rate at which fluid is infused and to monitor urine volume. The Console is mounted on a custom IV pole and is equipped with an internal battery that allows operation while the patient is being transported within a hospital. In addition to urine volume replacement, a user can set RenalGuard System to achieve a net fluid gain over and above matched hydration or to achieve a net fluid loss.

RenalGuard System allows infusion of a bolus of fluid at the user's request. In addition, the system is capable of adjusting matched hydration to take into account other fluid sources. RenalGuard System is CE-marked for the intended use of temporary (up to 14 days) replacement of urine output by infusion of a matched volume of sterile replacement solution to maintain a patient's intravascular fluid volume, and has demonstrated accurate matched replacement and an appropriate safety profile with normal saline in limited human use

More on how the RenalGuard works you can see on the company's website.

Financials PLC Systems

In the 10-Q filing I noticed that in the first quarter the company incurred a net loss from operations before taxes of approximately $7,808,000 and used cash in operations of approximately $2,158,000. As of March 31, 2013, cash and cash equivalents were $1,863,000. Management expects that quarterly losses and negative cash flows will continue during 2013. Based upon the current financial condition of the company and the expectation of continued quarterly losses during 2013, management is currently investigating ways to raise additional capital that can be completed in the next several months.

The company believes that its existing resources, based on its currently projected financial results, are sufficient to fund operations through the third quarter of 2013. Based upon current and anticipated revenue projections from foreign sales of our RenalGuard product, and the anticipated costs of its U.S. clinical trial, PLC Systems expect that they will need to raise additional capital during the remainder of 2013. The company was able to raise an additional $4,040,000 in capital on February 22, 2013, through the completion of financing with Palladium Capital Advisors LLC..

With the sale of their TMR business in February 2011, the company's future prospects are solely dependent upon the successful commercialization of RenalGuard. To date PLC Systems has recorded only a limited amount of sales of RenalGuard, principally to a single customer in one country, Italy.

The ability to effectively market RenalGuard outside the U.S. is largely dependent on the reception of the results of the MYTHOS and REMEDIAL II investigator-sponsored clinical trials.

The RenalGuard System has only had limited testing in a clinical setting in the United States so the company may need to modify it substantially in the future for it to be commercially acceptable in the broader market.

Despite all these financial risks mentioned above I think the company offers a compelling opportunity to profit from the growing CIN market with a market value of more than $500 million.

Final Note

CIN is one of the leading causes of hospital-acquired acute renal failure. It is associated with a significantly higher risk of in-hospital and 1-year mortality, even in patients who do not need dialysis.

Nonrenal complications include procedural cardiac complications, vascular complications, and systemic complications.

There is a complicated relationship between CIN, comorbidity, and mortality. Most patients who develop CIN do not die from renal failure. Death, if it does occur, is more commonly from either a preexisting nonrenal complication or a procedural complication.

Many physicians who refer patients for contrast procedures and some who perform the procedure themselves are not fully informed about the risk of CIN. A survey found that less than half of referring physicians were aware of potential risk factors, including diabetes mellitus.

Patients with risk factors for CIN should be educated about the necessity of follow-up care with their physicians with a postprocedure SCr estimation, especially if the initial procedure was done on an outpatient basis.

Specifically, prevention strategies involving calcium-channel blockers, endothelin receptor antagonists, theophylline, prostaglandins, diuretics, anti-oxidants, or other reno-protective drugs have been shown to have no benefit or to have little consistent effect.

I believe the Benefit Catether of AngioDynamics and the RenalGuard Therapy of PLC Systems are until now the only two successful treatments hospitals are looking for.

Contrast-induced nephropathy ("CIN") is defined as the impairment of renal function and is measured as either a 25% increase in serum creatinine from baseline or 0.5 mg/dL (44 µmol/L) increase in absolute value, within 48-72 hours of intravenous contrast administration.

For renal insufficiency ("RI") to be attributable to contrast administration, it should be acute, usually within 2-3 days, although it has been suggested that RI up to 7 days post-contrast administration be considered CIN; it should also not be attributable to any other identifiable cause of renal failure.

The CIN market is a more than $500 million market which can be conquered by niche players such as AngoDynamics (ANGO), PLC Systems (PLCSF.OB) and Australian listed Osprey Medical. Bristol-Meyers Squibb (BMY) has a lack of clear supporting clinical data for its preventive product so they will not profit from this market going forward.

Current Treatment Methods for CIN

The only clinically accepted and routinely utilized preventive measure for patients at risk for CIN is pre- and post- procedure overnight hydration, which is inconvenient, expensive and time-consuming for hospital staff.

There is currently no FDA-approved device or drug for CIN prevention, but it is expected that this will change soon.

Due to the attractiveness of the potential market, there are a number of other companies developing or investigating potential new CIN preventive drugs, devices and therapies.

Preventive measures being used in clinical practice today include:

Mucomyst® N-acetylcysteine (Mucomyst®)

Mucomyst is both a renal vasodilator and antioxidant. It is produced by Bristol-Meyers Squibb . It is prescribed by a doctor prior to the start of an interventional procedure and is taken by the patient in prearranged doses that may start the day before the procedure. This therapy is employed by many physicians due to an extremely low risk profile and cost. A team of Brazilian researchers published data on the largest trial of Mucomyst to date, the ACT Trial. They reported that after studying Mucomyst in 2,308 patients, the rate of CIN was identical between the group of patients who received the drug and those who did not. The results of the ACT trial have reduced the use of Mucomyst as a preventative therapy at many centers.

Sodium bicarbonate

Sodium bicarbonate is a pre-mixed pharmaceutical solution that is given intravenously on the same day as the procedure, prior to the start. A small number of published studies that have evaluated utilizing sodium bicarbonate as a preventive measure. Meta-analysis of these studies and larger studies of the therapy have failed to demonstrate a clear benefit to sodium bicarbonate. The lack of solid clinical evidence for this therapy has led to the a tapering off of the use of sodium bicarbonate at many hospitals.

Device-Based Treatments

CINCOR System

Osprey Medical Systems, formerly known as V-Kardia, Inc., is a United States-based medical device company listed on the Australian Stock Exchange. The company develops catheter based technologies to minimize contrast induced neuropathy ("CIN") in patients with chronic kidney disease. It offers CINCOR contrast removal system, a catheter and vacuum system, which is designed to remove dye (contrast) from the heart before it can enter the kidneys and cause damage known as contrast induced nephropathy ("CIN").

The CINCOR system can be activated multiple times throughout the heart procedure. At the conclusion of the procedure, the small amount of dye-laden blood is discarded. has announced that it has received CE Mark for its CINCOR system and the Osprey announced in March enrolment of their first patient in the CINCOR IDE Clinical Study at the Leipzig Heart Centre in Germany. The multi-country trial will be conducted in 30 hospitals enrolling 600 patients with complete enrolment and FDA submission expected in 2014.

Osprey's public statements list the CINCOR price as between $1500-$2000. Market challenges for this approach may include concerns regarding complications of placing a catheter in the coronary sinus, lack of clear supporting clinical data, and the significant cost of the system. Additionally, published reports to date only indicate that CINCOR removes on average 32% of the contrast injected, which still allows a significant volume of potentially dangerous contrast to pass to the patient's kidney.

CINCOR only works for coronary interventions, so the technology cannot be used in patients undergoing peripheral catheterizations, transcatheter aortic-valve implantation (TAVI), or contrast enhanced CT.

Benephit Catheter

In January 2009, AngioDynamics Inc. acquired certain assets of FlowMedica, Inc., including its Benephit® CV Infusion System, which is a catheter designed to deliver drugs and/or fluid directly to the renal arteries during an interventional procedure.

This system is FDA 510(k)-cleared and CE-marked for the infusion of physician-specified agents in the peripheral vasculature. The Benephit XT infusion system was designed as a universal system to facilitate local drug delivery in multiple settings, as a stand-alone intervention or in conjunction with another medical, interventional or surgical procedure. The system consists of a bifurcated infusion catheter and dedicated 5F introducer sheath that allows for placement from femoral or brachial access sites. The system was designed to provide stability in the vasculature to allow usage in multiple clinical settings as well as in cases where patients may require transport between locations with the Benephit system placed.

In addition to the XT system, AngioDynamics manufactures the CV, Solo and Mini versions for use in specific clinical situations. The Benephit CV system is used primarily in coronary cases if simultaneous infusion is desired during the procedure. The Benephit Solo catheter has one open lumen for those patients with only one open renal artery or one kidney. The Benephit Mini catheter is for use in patients with small aortas, such as those patients with small stature.

In a subset of 285 patients in the BE-RITe registry, the incidence of CIN was 71% lower than predicted (8.1% actual CIN versus 28% predicted) using Mehran risk scoring method. In the BE-RITe registry, catheter-related complications were rare with only 1 case (0.2%) of renal artery dissection that was immediately stented without compromising renal function or causing long-term sequelae.

At the Scripps Clinic in La-Jolla, CA, Dr. Paul Teirstein's study of 33 patients showed a significant increase in renal function with Targeted Renal Therapy ("TRT") compared to IV which was sustained for 2 hours post procedure.

Financials AngioDynamics

AngioDynamics net sales for the third quarter were $81.6 million, compared to $51.6 million reported for the third quarter of fiscal 2012. The company reported a GAAP net loss of $0.03 per share and adjusted earnings per share of $0.08.

"We had a very challenging sales quarter," said Joseph M. DeVivo, President and Chief Executive Officer. "Our U.S. Sales organization is still managing the effects of significant change while re-establishing positive momentum in our business. Third quarter sales were in line with our reduced expectations, while we continued to execute operationally, generating higher profitability than our revised expectations by successfully delivering cash improvements and cost savings. We remain confident in our business model, and are encouraged by positive movement, including converting several large PICC accounts to BioFlo, selling NanoKnife generators to European Urologists, generating ahead of plan AngioVac sales, recognizing our first U.S. Microsulis sales and executing a U.S. sole-source IDN agreement potentially worth more than $2 million annually. We firmly believe our acquisitions and investments position us to become a more competitive force in the markets we serve, and are committed to delivering top and bottom line growth for our investors."Diluted average shares outstanding increased to 35.3 million in the quarter from 25.1 million in the prior year period due to the additional shares issued in conjunction with the Navilyst Medical acquisition. Third quarter EBITDA grew to $6.5 million, or $0.19 per share, compared to $0.4 million, or $0.02 per share, a year ago. Adjusted EBITDA, excluding the items shown in the attached reconciliation table, increased to $12.7 million, or $0.37 per share, in the third quarter compared to $6.1 million, or $0.24 per share, a year ago. During the third quarter, operating cash flow improved to $10 million compared to $6.8 million in the prior year quarter. At February 28, 2013, cash and investments were $18.8 million, and debt was $144.4 million.

In February, AngioDynamics completed the acquisition of certain assets of Microsulis Medical Ltd., including the Acculis MTA microwave ablation system. The system utilizes a single, high-power, high-frequency 2.45 GHz saline-cooled applicator that may provide advantages to clinicians and patients, including faster ablation of soft tissue. During the quarter, the company recognized its first Microsulis sales in the U.S. During the quarter, AngioDynamics executed a sole source contract with a leading IDN to provide vascular access products including ports and peripherally inserted central catheters (PICCs) to their members.

For the nine months ended February 28, 2013, net sales were $252 million, a 54% increase over the $164.1 million reported a year ago and flat on a pro forma basis. Net income was $0.3 million, or $0.01 per share, compared to net income of $1.9 million, or $0.08 per share, as reported a year ago. Adjusted net income, excluding costs relating to the Navilyst Medical acquisition, as well as other costs detailed in the attached reconciliation table, was $9.9 million, or $0.28 per share, compared to $4.7 million, or $0.19 per share, a year ago. Adjusted EBITDA was $39.7 million, or $1.12 per share, compared to $19.4 million, or $0.77 per share, a year ago.

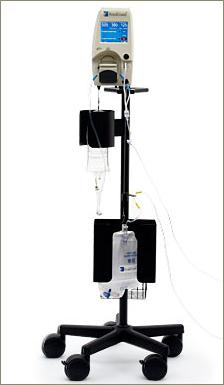

RenalGuard

RenalGuard® is designed to reduce the potentially toxic effects that contrast media can have on the kidneys when it is administered to high-risk patients during certain medical imaging procedures. It is believed that allowing contrast media to dwell in the kidneys of certain higher risk patients can lead to contrast-induced nephropathy ("CIN"), a potentially deadly form of acute kidney injury. By inducing and maintaining a high urine flow rate before, during and after these medical imaging procedures, the incidence rates of CIN in at-risk patients can be reduced. RenalGuard facilitates this increased urine clearance automatically, enabling the body to more rapidly void the contrast media, thereby reducing its overall resident time and toxic effects in the kidney. RenalGuard® is manufactured by PLC Systems and is currently an investigational device in the U.S.

It is a safe, innovative technology capable of achieving significant market adoption due to its evidence-based therapy and straightforward integration into hospital environments where contrast agents are routinely used.

The effectiveness of RenalGuard has been demonstrated in two randomized, open-label controlled clinical trials. Both of these studies reported that inducing very high urine outputs with precise matching of intravascular volume significantly reduced the incidence of CIN in at-risk patients.

The RenalGuard System™ is comprised of a Console and a RenalGuard Single Use Set for infusion and urine collection. The Single Use Set contains a urine collection set which connects to a patient's Foley catheter and an infusion set which connects to a standard IV catheter.

The Console measures the volume of urine in the collection set and infuses an equal volume of hydration fluid to match the patient's urine output. The Console relies on proprietary, patented software and electronic weight measurements to control the rate at which fluid is infused and to monitor urine volume. The Console is mounted on a custom IV pole and is equipped with an internal battery that allows operation while the patient is being transported within a hospital. In addition to urine volume replacement, a user can set RenalGuard System to achieve a net fluid gain over and above matched hydration or to achieve a net fluid loss.

RenalGuard System allows infusion of a bolus of fluid at the user's request. In addition, the system is capable of adjusting matched hydration to take into account other fluid sources. RenalGuard System is CE-marked for the intended use of temporary (up to 14 days) replacement of urine output by infusion of a matched volume of sterile replacement solution to maintain a patient's intravascular fluid volume, and has demonstrated accurate matched replacement and an appropriate safety profile with normal saline in limited human use

More on how the RenalGuard works you can see on the company's website.

Financials PLC Systems

In the 10-Q filing I noticed that in the first quarter the company incurred a net loss from operations before taxes of approximately $7,808,000 and used cash in operations of approximately $2,158,000. As of March 31, 2013, cash and cash equivalents were $1,863,000. Management expects that quarterly losses and negative cash flows will continue during 2013. Based upon the current financial condition of the company and the expectation of continued quarterly losses during 2013, management is currently investigating ways to raise additional capital that can be completed in the next several months.

The company believes that its existing resources, based on its currently projected financial results, are sufficient to fund operations through the third quarter of 2013. Based upon current and anticipated revenue projections from foreign sales of our RenalGuard product, and the anticipated costs of its U.S. clinical trial, PLC Systems expect that they will need to raise additional capital during the remainder of 2013. The company was able to raise an additional $4,040,000 in capital on February 22, 2013, through the completion of financing with Palladium Capital Advisors LLC..

With the sale of their TMR business in February 2011, the company's future prospects are solely dependent upon the successful commercialization of RenalGuard. To date PLC Systems has recorded only a limited amount of sales of RenalGuard, principally to a single customer in one country, Italy.

The ability to effectively market RenalGuard outside the U.S. is largely dependent on the reception of the results of the MYTHOS and REMEDIAL II investigator-sponsored clinical trials.

The RenalGuard System has only had limited testing in a clinical setting in the United States so the company may need to modify it substantially in the future for it to be commercially acceptable in the broader market.

Despite all these financial risks mentioned above I think the company offers a compelling opportunity to profit from the growing CIN market with a market value of more than $500 million.

Final Note

CIN is one of the leading causes of hospital-acquired acute renal failure. It is associated with a significantly higher risk of in-hospital and 1-year mortality, even in patients who do not need dialysis.

Nonrenal complications include procedural cardiac complications, vascular complications, and systemic complications.

There is a complicated relationship between CIN, comorbidity, and mortality. Most patients who develop CIN do not die from renal failure. Death, if it does occur, is more commonly from either a preexisting nonrenal complication or a procedural complication.

Many physicians who refer patients for contrast procedures and some who perform the procedure themselves are not fully informed about the risk of CIN. A survey found that less than half of referring physicians were aware of potential risk factors, including diabetes mellitus.

Patients with risk factors for CIN should be educated about the necessity of follow-up care with their physicians with a postprocedure SCr estimation, especially if the initial procedure was done on an outpatient basis.

Specifically, prevention strategies involving calcium-channel blockers, endothelin receptor antagonists, theophylline, prostaglandins, diuretics, anti-oxidants, or other reno-protective drugs have been shown to have no benefit or to have little consistent effect.

I believe the Benefit Catether of AngioDynamics and the RenalGuard Therapy of PLC Systems are until now the only two successful treatments hospitals are looking for.

Adept Technology, An Acquisition Candidate? - Part II

In Part I of this series on Adept Technology (ADEP), I talked about the company and the turnaround that is taking place. I also described the robotic market and the main competitors in this area. Now it's time to look ahead and what we think will happen to Adept Technology going forward.

Read more on Seeking Alpha

Read more on Seeking Alpha

Thursday, May 9, 2013

Fantasy Sports Betting Boom Gives Investors Several Opportunities

Americans' attendance at sporting events has been steadily increasing over the past decade, but their fantasy participation has been growing at an even quicker rate.

A small player that entered the market is a company called MGT Capital Investments (MGT). The company is primarily engaged in the business of acquiring, developing and monetizing intellectual property rights. On April 22, the company announced that its wholly owned subsidiary, MGT Sports, Inc., has reached an agreement to acquire a controlling interest in FanTD LLC, marking the company's initial venture in the online and mobile gaming and wagering space.

Read More on Seeking Alpha

Wednesday, May 8, 2013

MusclePharm, An American Success Story

As stated in my previous article: "A Closer Look At MusclePharm," the company develops, markets and sells athlete-focused, high quality nutritional supplements primarily to specialty resellers. In this article you'll find new information why MusclePharm is leading the way.

Read More On Seeking Alpha

Adept Technology, A Robotic Opportunity - Part I

'Automation' is the growing phenomenon of human labor being replaced by machinery and robotics. Automation can be positive for businesses by increasing labor productivity, reducing wage costs, increasing profit margins and also filling labor shortages, as has happened in China.

One U.S. company that is a robotic opportunity for investors looking for exposure in the field of automation I am going to describe in this article. The company is called Adept Technology (ADEP).

DelMar Pharmaceuticals: A Small Cap Worth Considering

Investment Thesis

DelMar Pharmaceuticals is a clinical & commercial stage oncology company that has a well-validated lead drug candidate VAL-083, that holds commercial rights to their lead product in China. The management has a history of successful exits: Matrix and Chemgenix.

VAL-083

The company has a lead product candidate called VAL-083. VAL-083 is a bi-functional alkylating agent, with potential antineoplastic activity. VAL-083 crosses the blood brain barrier (BBB) and appears to be selective for tumor cells. This agent alkylates and crosslinks DNA which ultimately leads to a reduction in cancer cell proliferation. In addition, VAL-083 does not show cross-resistance to other conventional chemotherapeutic agents and has a long half-life in the brain.

Read more on Seeking Alpha

Friday, May 3, 2013

Intellectual Property: Hype Or Real Deal?

One of the biggest international business law trends this year is Intellectual Property. Last year's legal battle between Apple (AAPL) and Samsung (SSNLF.PK) was an excellent preview of the major trend to look out for in 2013 - the explosion in the number of international intellectual property disputes.

Intellectual Property - like never before, it's worth fighting for.

A great way investors can seek profit from this trend is looking for companies that focus on Intellectual Property services. I came across three listed companies that could be interesting investments going forward.

Read more on Seeking Alpha

Wednesday, May 1, 2013

Looking Into The Specialty Pharmacy Sector

In 2012, Americans filled more than 4 billion prescriptions at 62,000 retail, mail, and specialty pharmacies. The largest U.S. pharmacies ranked by total prescription you will find in the table below, some of these companies offer also specialty pharmacy services (CVS Caremark and Express Scripts). We think the specialty pharmacies sector offers a great opportunity for investors that want to stay ahead of the curve.

Read more on Seeking Alpha

Subscribe to:

Posts (Atom)